Who says Trump doesn’t make money for shareholders?

Who says Trump doesn’t make money for shareholders?

inShare

November 8,

2016 | By Ian Williams

Astute IROs should restart the printing presses and ensure their

own celebrity CEO adorns stock certificates

A few

passing observations of the different operations needed to manufacture a sewing

needle and of the practices of canny 18th century Scottish bankers gave Adam

Smith the material for his concept of an ‘invisible hand’ that creates the

wealth of nations. When great ideas and perceptions come into proximity at the

same time, they can be sewn together to form a new pattern in the minds of men

and women.

Our era is

amazingly productive of such ideas. We have all sorts of theories, some

contradicting each other, but happily adopted simultaneously by national and

international leaders desperate to show they are ‘doing something’, as they

boldly go across the thin economic ice where none has gone before. Along with

trickle-down ‒ and trickle-up ‒ analysts try to cope with the increasing

reluctance of economic reality to follow their prescriptions, let alone their

predictions.

And

alongside these macroeconomic fads is the cult of the celebrity executive, the

CEO whose name is so numinous that it attracts offerings from awestricken

investors. It surely betokens some deep anthropological need on the part of

investors to gild their idols’ feet of clay, continually pumping money into

companies whose falling profits and stock prices are inversely proportional to

the compensation their management takes.

Ruminating

on the news that the Federal Reserve, picking up from European central banks,

was contemplating negative interest rates, I came across a scripophily

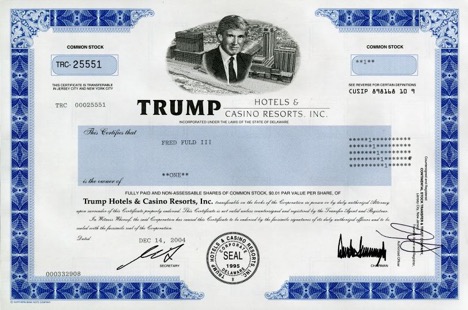

advertisement that proves the point. Trump Hotels and Resorts raised $140 mn at

its IPO 20 years ago ‒ and to show what made it attractive, its ticker symbol

was DJT, and its snazzy certificate not only had the man’s signature but also

had his portrait, hair and all.

Intriguingly,

the prospectus invoked ‘THE TRUMP NAME’ (sic) claiming that ‘The Company

capitalizes’ on the name’s ‘widespread recognition’, and ‘reputation for

quality’. It overlooked mentioning that the huge tax losses on the properties

had already been taken by the man selling them to the company that bore its

name, indemnifying him against income tax for decades. The NAME

notwithstanding, the stock price plummeted from $35 to 17 cents a share.

Predictably, the eponymous holder of the voting shares took out more than $80

mn in pay and benefits even as the company lost more than $1 bn.

And in case

readers think we are jumping on a bandwagon, I should point out that IR

Magazine’s Speculator column first adumbrated Trump’s business acumen 18 years ago and

returned to it 10 years ago.

Now some

investors of little faith might have been tempted to sell that stock, but true

believers in the Donald who held on to the share certificates gained the

benefits of long-term investors. The certificate shown below, obtainable for

mere pennies in 2004, is now selling for more than $140. Who said the Donald

never made money for shareholders!

Taken

together, this is inspirational for the investor relations community,

introducing a whole new dimension to shareholder value. Throw in Trump, retail

investors like those who bought into his company or Tyco, along with the idea

of negative interest and we have, blazing like the military-style lasers

probably spamming your mailbox now, negative dividends!This is

surely a concept whose time has come, since it simply formalizes the common

practice of shareholders paying for the privilege of compensating CEOs.

Since it is

THE NAME that counts, astute IROs should restart the printing presses and

ensure their own celebrity CEO adorns stock certificates and that stockholders

are invited to regular bean-feasts with their idol with pictures, regular

tweets and messages.

But we need

to formalize the returns for the designated celebrity and not just rely on the

vagaries of Chapter 11 ‒ hence the innovative idea of negative dividends.

Ordinary shareholders should pay quarterly to the company to ensure the CEO has

the lifestyle they emulate and want to vicariously share by being stockholders.

Like a government run on a no-tax basis, there might be a few glitches to begin

with, but the negative dividend has wings. It will fly – all the way to your

favorite tax haven!